Cryptocurrency

Organizations that do not wish to manage a crypto portfolio, but also do not want to miss out on potential crypto gifts, still have options!

Cryptocurrencies are considered property by the IRS and thus these types of donations are eligible for deduction. We definitely recommend that Organizations implement a crypto liquidation element in their gift acceptance policy.

By utilizing an intermediary processing 501(c)(3), US charities can accept and receipt the liquidated cash equivalent of a cryptocurrency, NFT, or NFT Drop donation with little or no fee and without any need to take custody of these property-based contributions.

Examples of validated intermediary processors are Cocatalyst Impact, Inc. and Crypto for Charity.

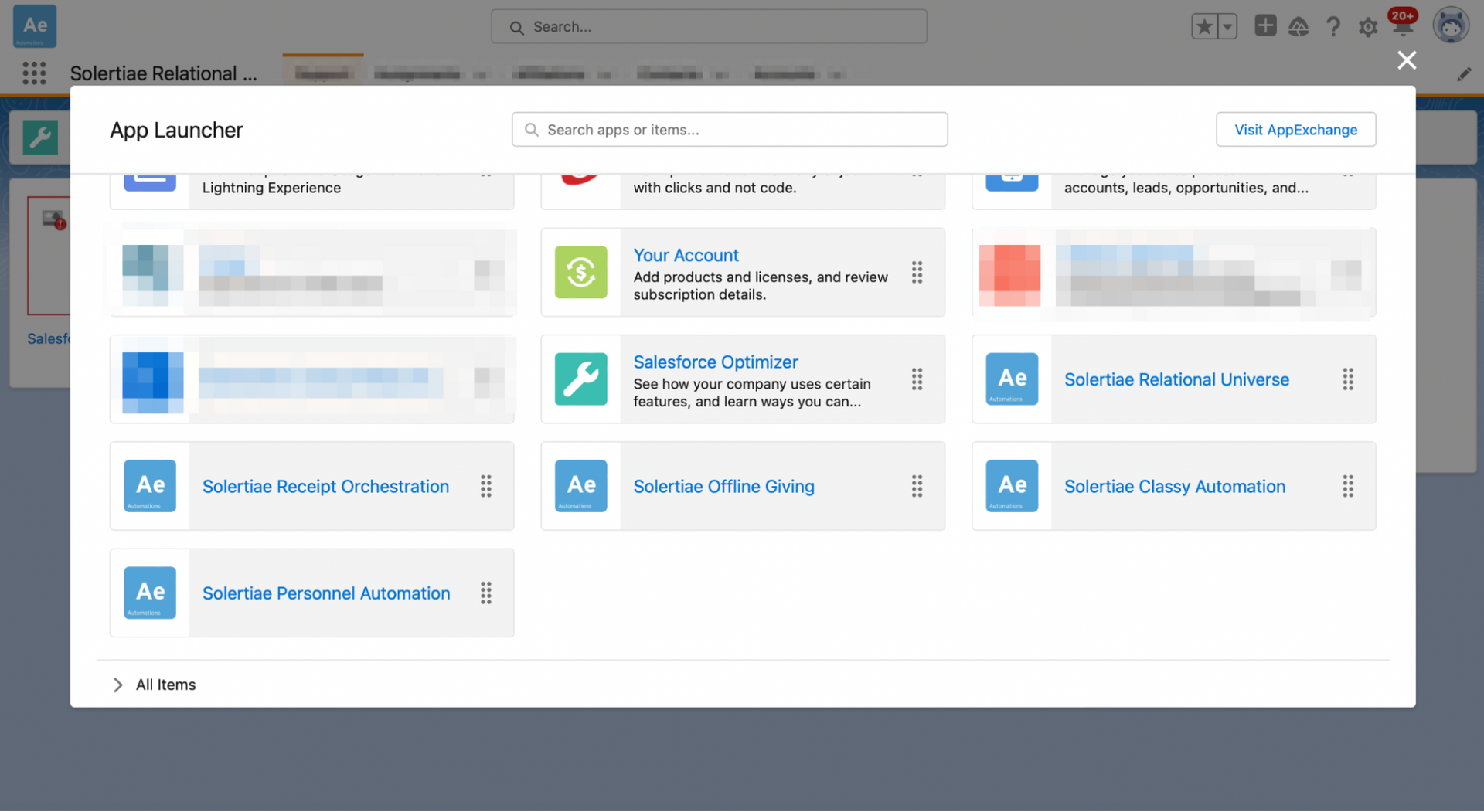

Solertiae also helps nonprofits with the following automated services: